The rapid rise of OpenAI and its potential $500 billion valuation signals a significant shift in the investment landscape, creating an “AI Gold Rush“. This article explores how this valuation might ripple through the stock market, influencing investment decisions related to publicly traded AI companies.

Table of Contents

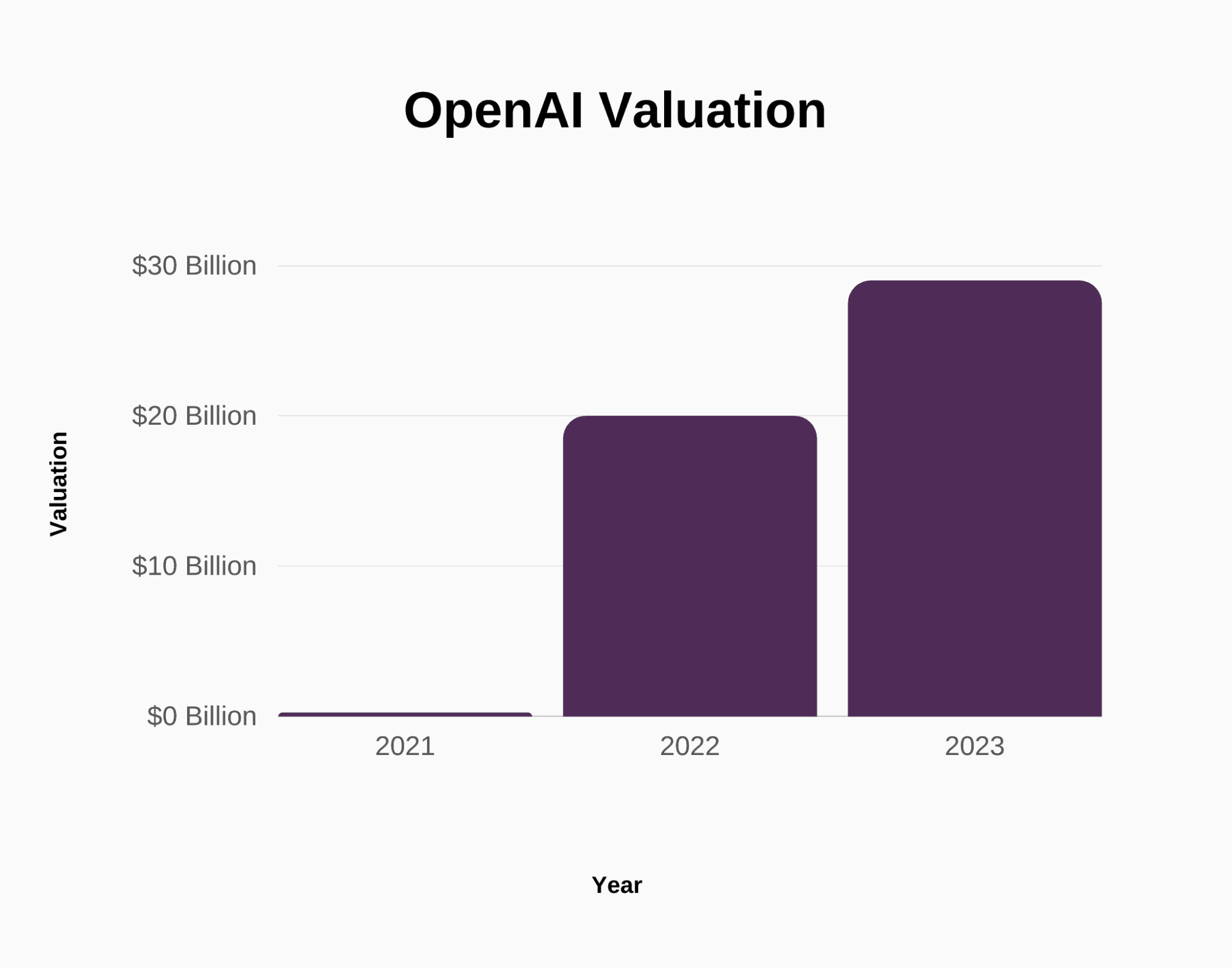

OpenAI’s Valuation Surge: A Closer Look

OpenAI, the company behind groundbreaking AI models like ChatGPT, is reportedly in early-stage talks for a secondary stock sale. According to Bloomberg, this sale could value the company at a staggering $500 billion. This represents a substantial increase from its previous valuation of $300 billion earlier in the year. The proposed sale would allow current and former employees to liquidate some of their holdings, providing an opportunity for outside investors to gain a stake in the AI giant. Thrive Capital is reportedly considering leading this investment round.

This surge in valuation underscores the intense investor enthusiasm surrounding AI companies, especially those perceived as leaders in the field. OpenAI’s rapid growth is fueled by the success of its products and services, including ChatGPT subscriptions, enterprise deals, and API access.

Revenue Growth Driving Valuation

The valuation isn’t just based on hype; it’s supported by impressive revenue figures. OpenAI’s annualized revenue reached $12 billion in July, doubling from the beginning of 2025. This exponential growth demonstrates the strong demand for AI solutions and OpenAI’s ability to monetize its innovations. This revenue milestone, reported across outlets like Investing.com and Maginative, further solidifies investor confidence and justifies the high valuation.

Impact on Stock Investments: The Ripple Effect

While OpenAI remains a private company, its soaring valuation can indirectly influence stock investments, particularly those related to publicly traded AI companies. Here’s how:

Increased Investor Sentiment

OpenAI’s success and high valuation contribute to a positive overall sentiment towards the AI sector. This optimism can translate into increased investment in other AI-related stocks. Investors may see OpenAI’s growth as an indicator of the potential of AI technology and seek to capitalize on this trend by investing in publicly traded companies involved in AI research, development, or deployment.

Benchmarking AI Companies

OpenAI’s valuation can serve as a benchmark for evaluating other AI companies. Investors might compare the financial performance and growth potential of publicly traded AI firms to OpenAI’s metrics. This comparison can help investors identify undervalued or overvalued stocks within the AI sector, guiding their investment decisions.

Spotlight on AI Infrastructure

The substantial fundraising and high valuation of OpenAI also highlight the significant capital requirements for AI startups, particularly those involved in training sophisticated models. This underscores the importance of companies providing the infrastructure and resources necessary for AI development. Investors may consider investing in companies that provide cloud computing, data storage, and specialized hardware for AI applications, as these companies are essential to supporting the growth of the AI industry.

Navigating the AI Investment Landscape

Investing in the AI sector requires careful consideration and due diligence. While the potential for growth is significant, the industry is also rapidly evolving and subject to technological advancements and competitive pressures. Here are some factors to consider when making AI-related investment decisions:

- Company Fundamentals: Evaluate the financial performance, revenue growth, and profitability of AI companies.

- Technological Innovation: Assess the company’s technological capabilities, research and development efforts, and intellectual property portfolio.

- Market Position: Analyze the company’s competitive landscape, market share, and strategic partnerships.

- Regulatory Environment: Consider the potential impact of regulations and policies on the AI industry.

It’s important to remember that past performance is not necessarily indicative of future results. Investors should conduct thorough research and consult with financial advisors before making any investment decisions.

The “AI Gold Rush” Continues

The potential $500 billion valuation of OpenAI underscores the ongoing excitement and investment pouring into the AI sector. While directly investing in OpenAI remains limited to private markets, the company’s success has a ripple effect, influencing investor sentiment and potentially boosting publicly traded AI-related stocks. Investors should carefully analyze individual companies, market trends, and the evolving regulatory landscape to make informed decisions in this dynamic and rapidly growing field.